Primark Strategy Case Study

Key Learning Outcomes

By the end of the case, students should be able to:

- Understand the broad macro-environment of Primark and the UK clothing retailing industry in terms of political, economic, social, technological, environmental and legal factors (PESTEL).

- Use our swot analysis example to gain an overall understanding of Primark's strengths and weaknesses and strategic options arising from the opportunities and threats that have been identified from the analysis of the business environment.

- To apply strategy business models and frameworks such as Pestle, Swot etc to real company cases.

Analyse the macro environment of Primark and UK clothing retail industry using pestle followed by a Swot Analysis.

- See also, Porters five forces analysis 2018

- See also, Porters value chain analysis 2018

1.0 INTRODUCTION

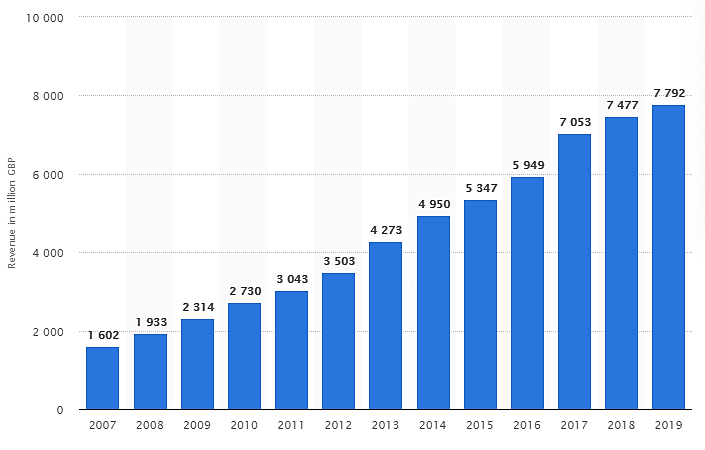

Primark is an Irish clothing retailer founded in Dublin in 1969. Currently operating over 350 stores across Europe (with 174 stores in the UK), Primark is part of Associated British Foods which acquired it in 2005 (Primark 2017). The retailer’s turnover grew by 19% to £7.05 billion in 2017 from 2016 while profits soared by 7% to £735 million (Butler 2017). Primark has enjoyed tremendous growth over the last 10 years due to its low cost fashion, growing from 4th largest clothing retailer in 2013 to 2nd in 2018 at expense of Arcadia Group and Next in a space of less than 4 years with only Marks & Spencer ahead.

Its market share stood at 7.1% as of August 2018, up from 6.9% share of the clothing market in 2017, ahead of Next with a market share of 6.7%. Leading the market share in the British clothing and accessories industry is Marks & Spencer with market share estimated at 8.9% (Statista 2018).

Its low costs have continued to attract new customers even with the post Brexit squeeze on high street spending. Despite the fall of retail store sales in late 2017, Primark profits soared by 7% to £735 million ahead of competitors like Marks & Spencer (Butler 2017).

Figure 1: Primark's revenue from 2007-2017

Source: Statista 2017

Primark Strategy Case Study

Key Learning Outcomes

By the end of the case, students should be able to:

- Understand the broad macro-environment of Primark and the UK clothing retailing industry in terms of political, economic, social, technological, environmental and legal factors (PESTEL).

- Use our swot analysis example to gain an overall understanding of Primark's strengths and weaknesses and strategic options arising from the opportunities and threats that have been identified from the analysis of the business environment.

- To apply strategy business models and frameworks such as Pestle, Swot etc to real company cases.

Analyse the macro environment of Primark and UK clothing retail industry using pestle followed by a Swot Analysis.

- See also, Porters five forces analysis 2018

- See also, Porters value chain analysis 2018

1.0 INTRODUCTION

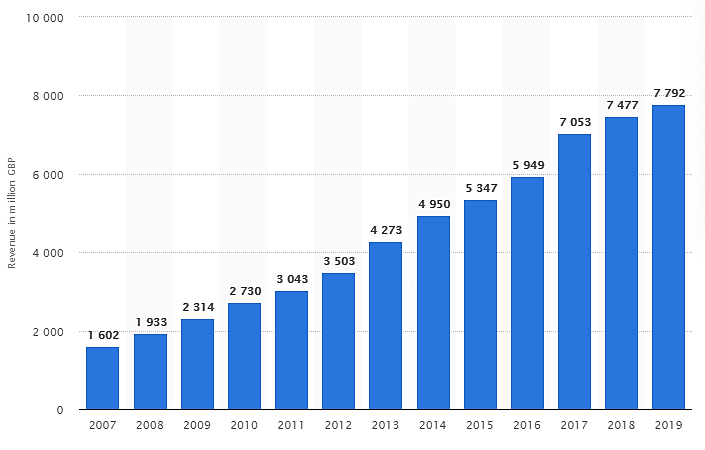

Primark is an Irish clothing retailer founded in Dublin in 1969. Currently operating over 350 stores across Europe (with 174 stores in the UK), Primark is part of Associated British Foods which acquired it in 2005 (Primark 2017). The retailer’s turnover grew by 19% to £7.05 billion in 2017 from 2016 while profits soared by 7% to £735 million (Butler 2017). Primark has enjoyed tremendous growth over the last 10 years due to its low cost fashion, growing from 4th largest clothing retailer in 2013 to 2nd in 2018 at expense of Arcadia Group and Next in a space of less than 4 years with only Marks & Spencer ahead.

Its market share stood at 7.1% as of August 2018, up from 6.9% share of the clothing market in 2017, ahead of Next with a market share of 6.7%. Leading the market share in the British clothing and accessories industry is Marks & Spencer with market share estimated at 8.9% (Statista 2018).

Its low costs have continued to attract new customers even with the post Brexit squeeze on high street spending. Despite the fall of retail store sales in late 2017, Primark profits soared by 7% to £735 million ahead of competitors like Marks & Spencer (Butler 2017).

Figure 1: Primark's revenue from 2007-2017

Source: Statista 2017